LOGO

Investment Objective

The Alpha Brands™ Consumption Leaders ETF (the “Fund”) has a primary investment objective to seek long-term capital appreciation. The Fund’s secondary investment objective is to seek to preserve capital during adverse market conditions.

Get an actively managed portfolio of many of the most admired, blue-chip brands

Own the Brands You Trust.

Invest Like a Logoist.

LOGO Sits at the Cross-Section of Brand Loyalty & Long-Term Investing.

Every day, billions of people make purchase decisions based on one key thing: the logo. Here’s a stat that’s eye-opening: Household consumption and business innovation spending around the globe accounts for $60+ trillion a year (McKinsey & Co., 2024). No other theme is larger than global consumption. From the sneakers we lace up to the platforms we stream on, trusted brands guide our choices. The LOGO ETF gives you exposure to the world’s most admired logos — powerful brands that dominate global consumption, culture, and mindshare.

Being a Logoist means more than brand loyalty — it’s about brand ownership. It’s the belief that the companies shaping our daily lives also belong in our portfolios. The LOGO ETF brings this idea to life by investing in dominant, consumer-facing companies that consistently earn attention, trust, and dollars around the world. And that’s not all. LOGO also invests in the global innovation spending boom as technology and AI remain at the center of everything. This is a theme that should not be avoided in your portfolio.

Bonus: The largest wealth transfer in history has just begun. Cerulli & Associates (2024) recently released a report estimating $2.5 trillion per year and growing will be added to the net worth of those inheriting over $100 trillion in wealth over the next 3 decades. What do consumers do when they have extra money? They tend to spend, save, and invest more. Mega Brands benefit disproportionately because they have earned our trust and loyalty.

Invest Like a Logoist by owning the LOGO ETF.

Fund Documents

LOGO Materials

Regulatory Documents

About Us

The sub-advisor for the LOGO ETF is Accuvest Global Advisors. Accuvest is a SEC-registered Registered Investment Advisor with $1.2 B in discretionary assets under management as of 6/30/2025. Accuvest is a subsidiary of Mosaic (MIG Inc), a global financial products and services company comprised of entities operating in multiple jurisdictions around the world. The firm traces back to 1983 with private banking roots. Today, the Mosaic Platform in aggregate, has nearly $5.6 billion in assets offering a comprehensive suite of financial products and services.

Portfolio Management Team:

CEO

David serves as the President and CEO of Accuvest Global Advisors. He is a member of the Investment Committee. David graduated with a B.A. in Economics and Spanish Translation from Brigham Young University, and a master’s degree in Business Administration, with a concentration in Finance, from the Haas School of Business at the University of California, Berkeley. David began his investment career in 1992 with Merrill Lynch, and then spent 10 years as a consultant with Smith Barney, serving the needs of affluent families, Foundations and Endowments. In 2005, David founded Accuvest to help his clients navigate increasingly complex global markets. He has been featured on TV, radio and in print media with Bloomberg, CNBC, Fox Business, Wall Street Journal, Morningstar and Barron’s.

CIO

Eric serves as the Chief Investment Officer for Accuvest Global Advisors. He is a member of the Investment Committee. Eric is a brand logoist at his core. Eric’s responsibilities include research, investment analysis, technical analysis, macroeconomic commentary, and portfolio strategy & implementation. Eric also leads the sales, marketing & distribution efforts of the Alpha Brands suite of investment strategies. Eric has over three decades of investment experience and started his career at Merrill Lynch in 1993. He graduated with a B.A. in Urban Planning with an emphasis on Real Estate & Economics from the University of Maryland, College Park. Eric is a frequent guest across top media outlets including CNBC, Bloomberg, Reuters, Wedbush, and The Schwab Network.

Key Features & Facts of LOGO ETF

Risk Managed.

Fund Details

| Fund Name | Alpha Brands Consumption Leaders ETF |

|---|---|

| Fund Inception | 5/27/2025 |

| Ticker | LOGO |

| Primary Exchange | NASDAQ |

| CUSIP | 45259A449 |

| Expense Ratio* | 0.69% |

| 30 Day SEC Yield* As of 12/31/2025 | -0.08% |

Fund Data and Pricing

| Name | Value |

|---|---|

| Net Assets | $27.69m |

| NAV | $21.30 |

| Shares Outstanding | 1,300,000 |

| Premium/Discount Percentage | 0.02% |

| Closing Price | $21.30 |

| Median 30 Day Spread* | 0.24% |

As of 01/14/2026

Media & Ongoing Portfolio Updates

Launch Episode for LOGO: Why global consumption. Why Global Brands. Why a Risk Managed Approach.

LOGO ETF Portfolio Manager on CNBC talks about the state of the consumer & leading retail brands

Logo ETF Portfolio Manager on The Street.com, Eric talks about how to focus on Consumer Spending Stocks

LOGO ETF Portfolio Manager talks about his favorite brands and the AI deployment theme on Schwab TV Network

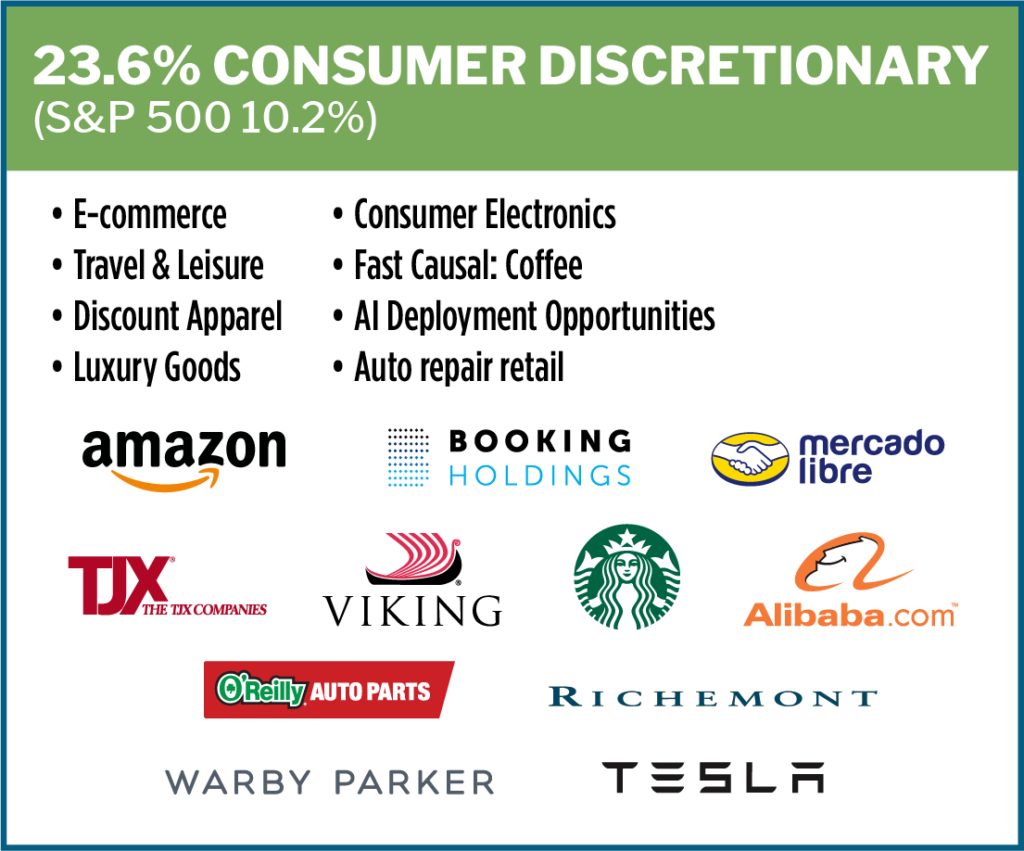

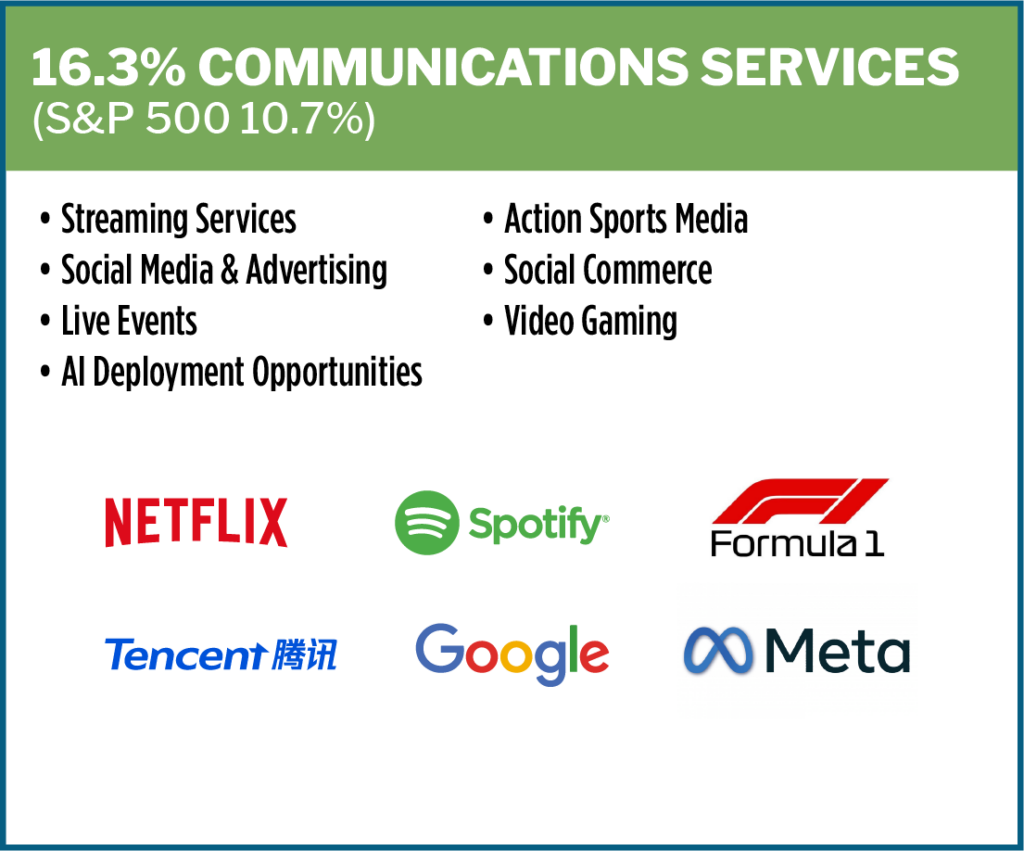

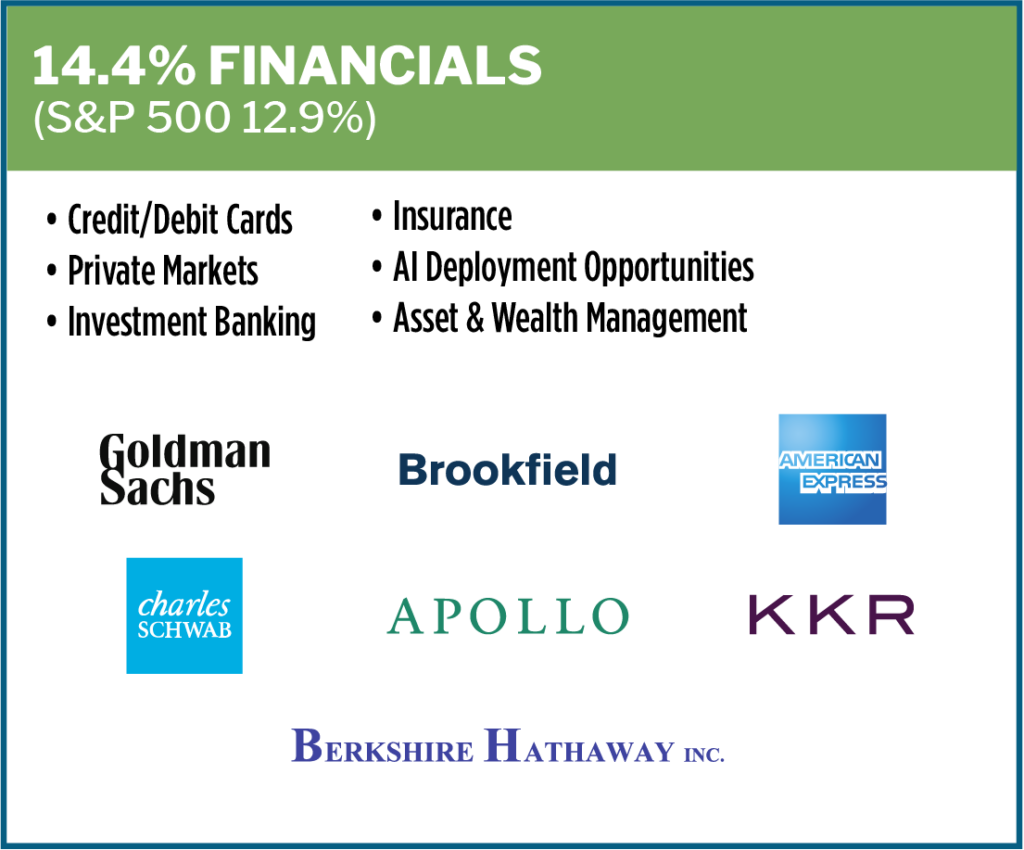

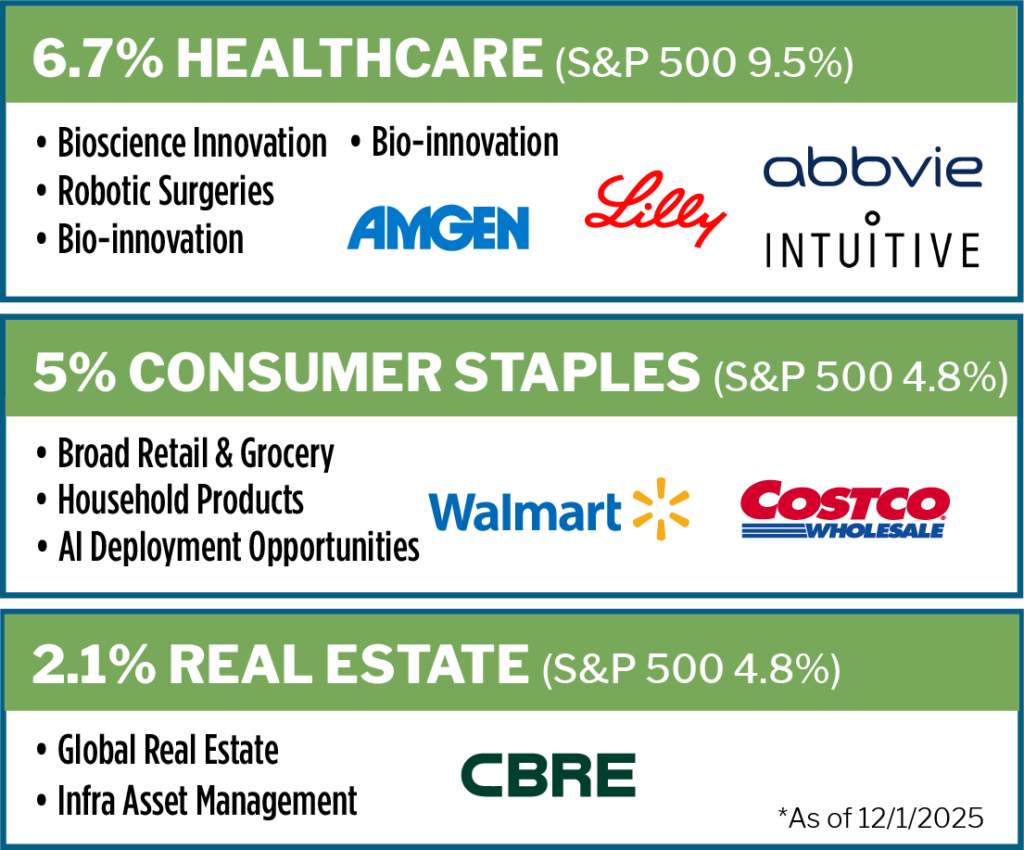

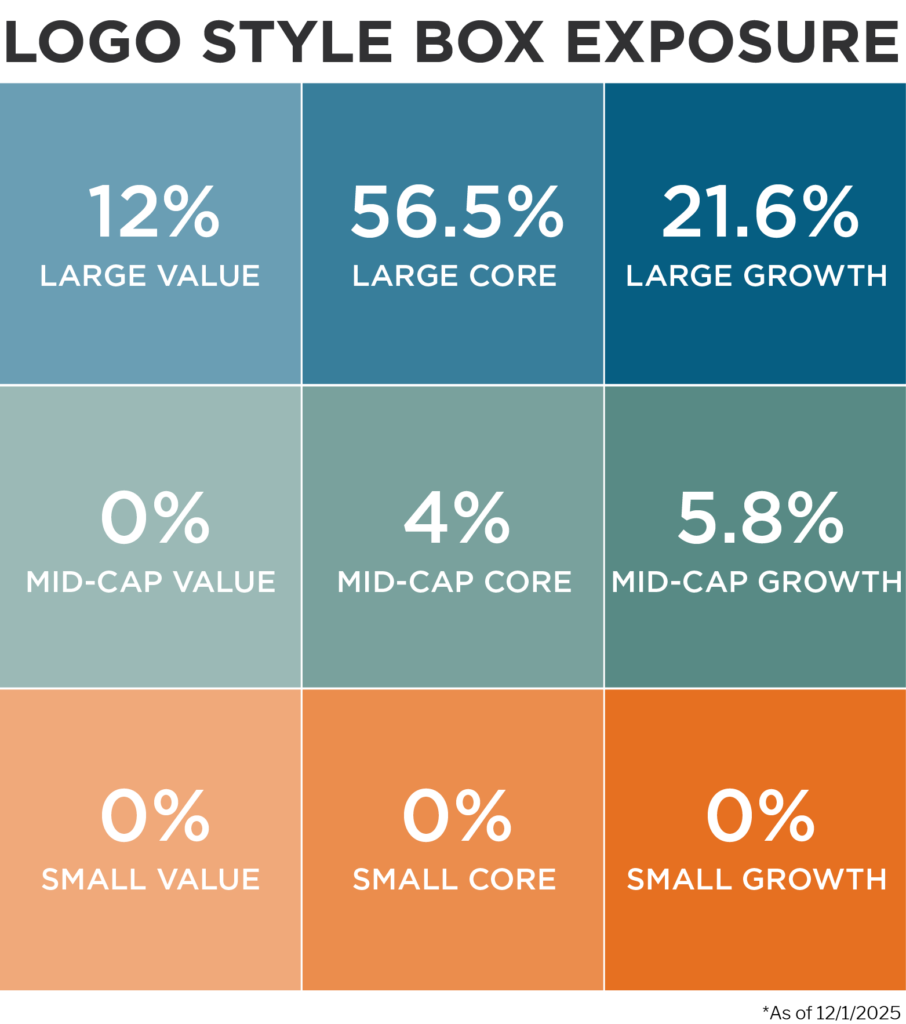

LOGO ETF Exposures

Understanding the business cycle is vital to portfolio positioning decisions. When the economy is performing well, and consumers are spending more broadly, LOGO will generally have more exposure to economically sensitive Alpha Brands (Offense). When the economy is slowing and/or macro events are creating a headwind to economic growth, LOGO will generally have increased exposure to defensive business models (Defense). Why? In times of high market turmoil, money tends to rotate toward brands more focused on “the staples of life” than those tied to broad discretionary spending. Being able to toggle between offense and defense is a key differentiator for LOGO.

- Offense

- Defensives

- US

- International

LOGO Current Portfolio Positioning

Proprietary Market Risk Assessment

Global Consumption Exposures

Source, Accuvest. Information is as of 12/15/2025.

A pure consumer spending brand is a company whose primary business is selling products and services directly to consumers.

The pure B2B (Business to Business), Ai Cap-ex brands are the companies whose primary business is selling products and services to other businesses which includes being part of the consumption supply chain.

The Hybrid B2C, B2B category are for companies that do both Pure Consumer distribution and Pure B2B distribution.

LOGO Current Macro Risk Indicators

Informs LOGO Exposures

Performance

As of 12/31/2025

| Fund Name | Fund Ticker | 1 Month | 3 Month | 6 Month | YTD | 1 Year | 3 Year | 5 Year | 10 Year | Since Inception (Cumulative) | Since Inception (Annualized) | Date |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Alpha Brands Consumption Leaders ETF | LOGO MKT | 0.01 | -4.66 | 1.15 | - | - | - | - | - | 4.84 | - | 12/31/2025 |

| Alpha Brands Consumption Leaders ETF | LOGO NAV | -0.11 | -4.67 | 1.15 | - | - | - | - | - | 4.75 | - | 12/31/2025 |

| S&P 500 TR | SPTR2 | 0.06 | 2.66 | 11 | - | - | - | - | - | 16.46 | - | 12/31/2025 |

As of 12/31/2025

| Fund Name | Fund Ticker | 1 Month | 3 Month | 6 Month | YTD | 1 Year | 3 Year | 5 Year | 10 Year | Since Inception (Cumulative) | Since Inception (Annualized) | Date |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Alpha Brands Consumption Leaders ETF | LOGO MKT | 0.01 | -4.66 | 1.15 | - | - | - | - | - | 4.84 | - | 12/31/2025 |

| Alpha Brands Consumption Leaders ETF | LOGO NAV | -0.11 | -4.67 | 1.15 | - | - | - | - | - | 4.75 | - | 12/31/2025 |

| S&P 500 TR | SPTR2 | 0.06 | 2.66 | 11 | - | - | - | - | - | 16.46 | - | 12/31/2025 |

Top 10 Holdings

As of 01/15/2026

| Date | Account | StockTicker | Name | CUSIP | Shares | Price | Market Value | Weightings | NetAssets | SharesOutstanding | CreationUnits |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 01/14/2026 | LOGO | AMZN | Amazon.com Inc | 023135106 | 5497 | 242.6 | 1333572.2 | 4.82% | 27686880 | 1300000 | 52 |

| 01/14/2026 | LOGO | TSM | Taiwan Semiconductor Manufacturing Co Ltd | 874039100 | 3535 | 331.21 | 1170827.35 | 4.23% | 27686880 | 1300000 | 52 |

| 01/14/2026 | LOGO | AAPL | Apple Inc | 037833100 | 4416 | 261.05 | 1152796.8 | 4.16% | 27686880 | 1300000 | 52 |

| 01/14/2026 | LOGO | MELI | MercadoLibre Inc | 58733R102 | 555 | 2073.57 | 1150831.35 | 4.16% | 27686880 | 1300000 | 52 |

| 01/14/2026 | LOGO | GOOGL | Alphabet Inc | 02079K305 | 3302 | 335.97 | 1109372.94 | 4.01% | 27686880 | 1300000 | 52 |

| 01/14/2026 | LOGO | NOW | ServiceNow Inc | 81762P102 | 7794 | 138.19 | 1077052.86 | 3.89% | 27686880 | 1300000 | 52 |

| 01/14/2026 | LOGO | SPOT | Spotify Technology SA | L8681T102 | 1923 | 534.64 | 1028112.72 | 3.71% | 27686880 | 1300000 | 52 |

| 01/14/2026 | LOGO | BABA | Alibaba Group Holding Ltd | 01609W102 | 5501 | 167.01 | 918722.01 | 3.32% | 27686880 | 1300000 | 52 |

| 01/14/2026 | LOGO | WMT | Walmart Inc | 931142103 | 7355 | 120.36 | 885247.8 | 3.20% | 27686880 | 1300000 | 52 |

| 01/14/2026 | LOGO | FWONK | Liberty Media Corp-Liberty Formula One | 531229755 | 9707 | 90.79 | 881298.53 | 3.18% | 27686880 | 1300000 | 52 |

| 01/14/2026 | LOGO | NFLX | Netflix Inc | 64110L106 | 9587 | 90.32 | 865897.84 | 3.13% | 27686880 | 1300000 | 52 |

| 01/14/2026 | LOGO | TCEHY | Tencent Holdings Ltd | 88032Q109 | 10509 | 80.1 | 841770.9 | 3.04% | 27686880 | 1300000 | 52 |

| 01/14/2026 | LOGO | MSFT | Microsoft Corp | 594918104 | 1764 | 470.67 | 830261.88 | 3.00% | 27686880 | 1300000 | 52 |

| 01/14/2026 | LOGO | GS | Goldman Sachs Group Inc/The | 38141G104 | 841 | 938.15 | 788984.15 | 2.85% | 27686880 | 1300000 | 52 |

| 01/14/2026 | LOGO | TDG | TransDigm Group Inc | 893641100 | 538 | 1381.98 | 743505.24 | 2.69% | 27686880 | 1300000 | 52 |

| 01/14/2026 | LOGO | INTU | Intuit Inc | 461202103 | 1221 | 605.28 | 739046.88 | 2.67% | 27686880 | 1300000 | 52 |

| 01/14/2026 | LOGO | HEI | HEICO Corp | 422806109 | 2046 | 352.3 | 720805.8 | 2.60% | 27686880 | 1300000 | 52 |

| 01/14/2026 | LOGO | GE | GE AEROSPACE | 369604301 | 2169 | 327.23 | 709761.87 | 2.56% | 27686880 | 1300000 | 52 |

| 01/14/2026 | LOGO | COST | Costco Wholesale Corp | 22160K105 | 708 | 941.93 | 666886.44 | 2.41% | 27686880 | 1300000 | 52 |

| 01/14/2026 | LOGO | UBER | Uber Technologies Inc | 90353T100 | 7778 | 85.41 | 664318.98 | 2.40% | 27686880 | 1300000 | 52 |

| 01/14/2026 | LOGO | BKNG | Booking Holdings Inc | 09857L108 | 115 | 5314.71 | 611191.65 | 2.21% | 27686880 | 1300000 | 52 |

| 01/14/2026 | LOGO | GEV | GE Vernova Inc | 36828A101 | 920 | 652.09 | 599922.8 | 2.17% | 27686880 | 1300000 | 52 |

| 01/14/2026 | LOGO | KKR | KKR & Co Inc | 48251W104 | 4561 | 130.08 | 593294.88 | 2.14% | 27686880 | 1300000 | 52 |

| 01/14/2026 | LOGO | APO | Apollo Global Management Inc | 03769M106 | 4112 | 143.24 | 589002.88 | 2.13% | 27686880 | 1300000 | 52 |

| 01/14/2026 | LOGO | BX | Blackstone Inc | 09260D107 | 3786 | 155.25 | 587776.5 | 2.12% | 27686880 | 1300000 | 52 |

| 01/14/2026 | LOGO | SCHW | Charles Schwab Corp/The | 808513105 | 5764 | 101.18 | 583201.52 | 2.11% | 27686880 | 1300000 | 52 |

| 01/14/2026 | LOGO | DE | Deere & Co | 244199105 | 1167 | 499.52 | 582939.84 | 2.11% | 27686880 | 1300000 | 52 |

| 01/14/2026 | LOGO | CBRE | CBRE Group Inc | 12504L109 | 3446 | 164.71 | 567590.66 | 2.05% | 27686880 | 1300000 | 52 |

| 01/14/2026 | LOGO | TJX | TJX Cos Inc/The | 872540109 | 3530 | 158.14 | 558234.2 | 2.02% | 27686880 | 1300000 | 52 |

| 01/14/2026 | LOGO | WRBY | Warby Parker Inc | 93403J106 | 18800 | 29.09 | 546892 | 1.98% | 27686880 | 1300000 | 52 |

| 01/14/2026 | LOGO | AXP | American Express Co | 025816109 | 1525 | 358 | 545950 | 1.97% | 27686880 | 1300000 | 52 |

| 01/14/2026 | LOGO | SBUX | Starbucks Corp | 855244109 | 5767 | 90.56 | 522259.52 | 1.89% | 27686880 | 1300000 | 52 |

| 01/14/2026 | LOGO | APP | AppLovin Corp | 03831W108 | 766 | 668.63 | 512170.58 | 1.85% | 27686880 | 1300000 | 52 |

| 01/14/2026 | LOGO | ORLY | O'Reilly Automotive Inc | 67103H107 | 5302 | 94.63 | 501728.26 | 1.81% | 27686880 | 1300000 | 52 |

| 01/14/2026 | LOGO | LLY | Eli Lilly & Co | 532457108 | 438 | 1077.19 | 471809.22 | 1.70% | 27686880 | 1300000 | 52 |

| 01/14/2026 | LOGO | ISRG | Intuitive Surgical Inc | 46120E602 | 827 | 561.82 | 464625.14 | 1.68% | 27686880 | 1300000 | 52 |

| 01/14/2026 | LOGO | CAT | Caterpillar Inc | 149123101 | 719 | 636.53 | 457665.07 | 1.65% | 27686880 | 1300000 | 52 |

| 01/14/2026 | LOGO | FGXXX | First American Government Obligations Fund 12/01/2031 | 31846V336 | 66904 | 100 | 66903.61 | 0.24% | 27686880 | 1300000 | 52 |

| 01/14/2026 | LOGO | Cash&Other | Cash & Other | Cash&Other | 43399 | 1 | 43398.72 | 0.16% | 27686880 | 1300000 | 52 |

LOGO Sector & Thematic Exposures